Yield farming percentages can be deceiving.

Yield farming percentages can be deceiving.

When farming, it’s typical to see APR %’s in the thousands and APY %’s in the tens of thousands. These flashy returns are extremely enticing to newcomers who are comfortable with the token, already hold it, and simply need to deposit their holdings into a pool to start collecting immediate rewards.

So what’s deceiving about these high returns? The answer lies in the hidden losses that farmers are oftentimes unaware of.

In a perfect world, a yield farmer immediately recognizes rewards, harvests them for a profit, then compounds the earnings back into the principal for even bigger returns. Less obvious is that during this process, the concept of impermanent loss is taking place to some extent. Depending on its pace, it can rapidly outpace your gains, eating away your principal.

*The concept of impermanent loss described below is layered and complicated. I only intend to give a brief background and overview for your general awareness. Following the fundamental overview, I included a mathematical example for visual learners below.*

As a primer, yield farming exists because DeFi platforms use AMMs (automated market makers) instead of traditional order books. AMMs rely on algorithms instead of order matching to maintain their balance. The swap function many of us enjoy and rely on is only made possible by AMMs. The issue is that these platforms and skilled traders are actively arbitraging your stake away to keep the farm in balance. When you deposit to a yield farm, you are generally required to deposit two equivalent values of coins. Two different coins are required so that a pool can allow users to execute swaps. Impermanent loss can be defined as the loss one incurs from entering into a pool and collecting rewards vs. what they would be left with if they just held. Yes, HODLers often outperform yield farmers who still collect high yield! The most important thing to remember is that impermanent loss occurs when the separate values of the deposited coins diverge.

I repeat, impermanent loss occurs when the values of the deposited coins diverge.

Yes, if one coin’s value rises, and the other stays put, you are actually realizing a loss in the value of your deposit. The system is often working against you. When a farm first goes live with big yield incentives, it attracts a lot of attention and volatility. Investors will be trading in and out of the coins in the farm to participate, this brings volatility and loss! Remember, spot volatility is not your friend when farming – divergence means loss.

Yes, if one coin’s value rises, and the other stays put, you are actually realizing a loss in the value of your deposit. The system is often working against you. When a farm first goes live with big yield incentives, it attracts a lot of attention and volatility. Investors will be trading in and out of the coins in the farm to participate, this brings volatility and loss! Remember, spot volatility is not your friend when farming – divergence means loss.

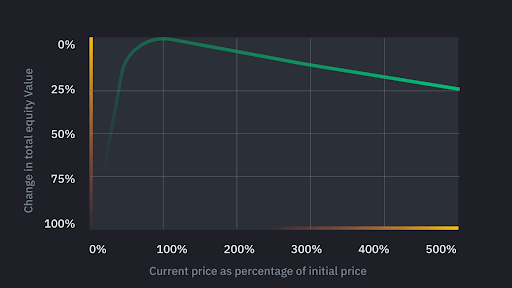

The loss is considered impermanent because it is unrealized until you pull your funds out of the farm. This is similar to unrealized losses on an asset you hold that has decreased in value. Again, impermanent loss happens when one of the two assets rises disproportionality and can happen at an even faster rate when one of the two assets decreases disproportionately. Impermanent loss does not incur if the two staked coins grow or shrink equivalently in percentage. The odds are incredibly low that their value ratios will remain exactly the same. You could make the argument that it’s impossible for the value ratio to remain identical, which is why the phenomenon is always occurring to some extent. The math behind the calculations of the loss is complex, which is why I suggest you familiarize yourself with the concept along with a loss chart before entering into a farm.

Below is a case study on the concept that is entirely hypothetical. The purpose is for you to clearly see why exactly your principal is losing value. Remember, to be successful in farming, the only thing you need to ensure is that your rewards > losses.

Let’s imagine the farm uses two coins, $WOLF and $PACK.

Let’s imagine the farm uses two coins, $WOLF and $PACK.

Wolf is trading at $100, and Pack is trading at $1.

This means that for our liquidity pool to function, the pool needs to maintain an even value of 50:50 between these two coins.

Right now, the pool has 9 Wolf coins and 900 Pack coins. You recognize the pool is offering a strong yield, so you decide to contribute 1 Wolf coin and 100 Pack coins. This ensures that the pool remains even. It now totals 10 Wolf coins and 1,000 Pack coins. The pool is currently valued at $2,000. With your contribution, you now own 10% of the funds in the pool, $200.

If a day passes and the coins remain the same price, you collect trading fees and you have an impermanent loss of $0. Furthermore, if a day passes and each coin rises 10%, you also have an impermanent loss of $0 and have made some gains on fees and price appreciation. This is a good thing!

What happens when differentiated volatility strikes? Let’s pretend that Wolf coin shoots up to $400 a coin and Pack coin retains its value at $1. This sounds like a great scenario – neither coin has lost value and one has pulled a 4X.

The 10 Wolf coins in the pool are now worth $4,000 and the 1,000 Pack coins are still worth $1,000. The pool has a new total value of $5,000. For the pool to function as designed, the pool needs to rebalance the total values, or its liquidity could be jeopardized. This is the role that market makers looking for arbitrage opportunities play, which I described above. Remember, the value of the Pack coin needs to equal the value of the Wolf coin.

So, what happens to the pool?

The pool is going to remove 50% of the Wolf coins and double the Pack coins. This would total out to 5 Wolf coins worth $2,000 and 2,000 Pack coins worth $2,000. The values of the tokens are rebalanced, but at what cost?

Remember, you own 10% of this pool, so when you withdraw your liquidity tokens and cash them in, you are entitled to .5 Wolf coins and 200 Pack coins. Together this is worth $400, not bad considering your initial investment was $200, right?

Wrong.

Your original Wolf coin at spot value would be worth $400 and Pack coin $100, a total of $500. You just experienced an impermanent loss of $100. You “lost” $100 by farming. HODLing would have been more profitable. This hypothetical situation is just one of many ways that farmers can incur a loss and is an example where the value actually rises. When one coin drops, your principle is on a fast track towards $0.

Now that you understand the concept, a reasonable question you probably have is how you can minimize the damage to still enjoy a profit.

There are a number of ways to mitigate impermanent loss. Perhaps most obvious is to be an incredibly skilled volatility trader with a comprehensive understanding of beta amongst varying assets. Beta can be defined as the measure of an asset’s volatility in relation to the overall market. The second minimization tactic relates to the first but takes a fundamental approach by utilizing cryptocurrencies in similar sectors for price correlation. You can also look for a pool that accepts stablecoins as one or both of the deposits to reduce the volatility of the two pairs. There are also pools that don’t require a 50:50 deposit ratio of the two coins, and others that offer a lockup to insure 0 losses or double rewards. No two pools are the same, which is why starting slowly and conducting thorough research are essential.

If you still want to jump right in, do so with a small percentage of your portfolio so that you can monitor your losses compared to your rewards. Even if the APY is ridiculously high, you can still just as easily end up with fewer coins or even nothing in a short amount of time.

Impermanent loss is a difficult concept to grasp and reinforces the idea that anything too good to be true likely is. DeFi platforms rarely advertise this concept, because it deters liquidity providers. Despite the crazy APY offered, spot holders will likely outperform farmers. If you are serious about farming, run the numbers. If it seems too good to be true, it probably is.

My goal from this blog is not to discourage you! I simply want to clarify the unadvertised risks. AMMs are made possible through incredible technology, are still finding their role, and perfecting their mechanics.

Enjoy the yield and be careful farming!