Bitcoiners often say that gold bugs are only one step away from becoming Bitcoin adopters due to investment strategy similarities. But is investing in gold really that similar to Bitcoin?

When it comes to owning gold, investors only have a few options on how they can gain exposure to the asset. The truest form of ownership, bullion, comes at the cost of paying a premium. This can potentially cost 5% or more, in addition to the spot price. Because of the premium, bullion investors are required to wait for a rise in price just to break even. Physical gold owners also have to consider proper storage and IRS approval. This is especially true if they want the gold they own to be a part of a tax-advantaged investment account. These inefficiencies leave investors with a dilemma. Should they invest in paper gold and give up true ownership, or truly own your gold, managing premiums and security.

The Evolution of Gold Investing

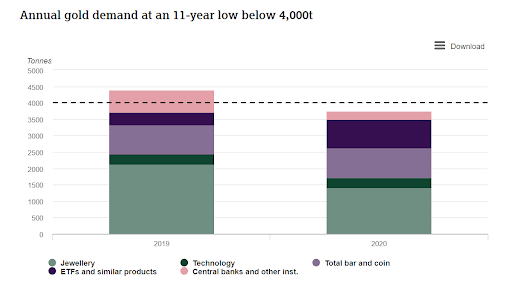

With the passage of time, investors willingly forgave ownership and opted into paper gold alternatives such as certificates, stocks, funds, fractional reserve bank accounts, and futures contracts. If you think the gold trading market isn’t that big, you are mistaken. In fact, half of the world’s gold is in jewelry, with about 30% used primarily for investment purposes. Furthermore, the new distribution of demand for incoming gold in 2020 has more than doubled compared to demand in 2019.

The onset of COVID had profound impacts on gold investors. Investors were once again reminded why owning gold matters – it stores your value in times of uncertainty. The irony is that gold investors once again faced the dilemma of pseudo ownership for a deal or physical ownership at “sky-high premiums.” Gold appreciated in value, but COVID revealed that the common practices of investing in the asset are squarely at odds with the desire to actually own the asset. This is why Bitcoin matters.

Bitcoin is Gold 2.0

We know gold investors are willing to step into the world of paper gold and forgo ownership in its truest form. But wait until they realize they can have their cake and eat it too with Bitcoin. Bitcoin offers investors the ability to choose true ownership without having to buy into rising premiums or pay for physical storage. Furthermore, Bitcoin offers far better liquidity than paper gold at the same level of ownership as physical gold. Gold will never simultaneously offer true ownership, simple storage, high-level liquidity, with low premiums.

Stating that Bitcoin is just one step away from gold is an oversimplification that does not do this emerging asset class justice. Bitcoin is an evolution of gold investing, a 2.0 version, retaining the same narrative and value proposition in a 21st-century style. In just 12 years’ time, both early adopters and legacy investors are finally realizing the better option – the one that’s on a path to improve and re-envision global finance.