There’s trading, and then there’s margin trading. If you’re reading this, then chances are you know what trading is, and you might even know what margin trading is. But do you really know how to margin trade properly? I can guarantee you, that 90 percent of margin traders don’t use it properly and end up increasing their risk or worse.

We explain the most common mistakes people fall into and how to turn those into strengths to make the most of margin trading.

What is Margin Trading?

Before I go into that, let me give a quick explanation of what margin trading is. Margin trading is essentially borrowing more money to let you trade with more capital than you have. So if you have $1,000 capital, margin trading at 5x will allow you to borrow $4,000 more to bring your tradable capital up to $5,000, or 5 times your actual capital. You will pay interest each day on the borrowed amount. But you keep all the profits you make from trading the $5,000.

Sounds like an easy way to make money right? Well, you also have to pay back the $4,000 you borrowed, regardless of if you lose any or all of it.

Worse odds than a casino

The first thing you need to understand is why and how you want to use margin trading. The majority of people will use it to increase their risk in the hopes of getting even greater returns, and generally, won’t have any risk management strategies. They will put in their full balance of capital, and then borrow to trade 5, 10, or even 100 times that amount which inevitably is increasing your risk factor by a ridiculous amount! You probably have better odds at a casino to be honest!

So, if that’s how not to margin trade, then how do you margin trade? Well, for many professionals, it’s almost the exact opposite. They use margin trading to reduce their risk and to help in adhering to strict risk management strategies.

Reducing risk

So you’ve likely heard the phrase, not your keys, not your money. But the only way to trade is to put your money on an exchange, which is going to be centralized if you’re doing margin trading. So putting $100,000 on a centralized exchange has its own risk: risk of hacking, risk of exchange issues, risk of the exchange even just disappearing. These are the risks that get reduced when you margin trade correctly. Instead of putting all $100,000 on there, you only put $20,000 on the exchange and borrow the remaining $80,000. So you’re still only trading what you normally would trade, but you have reduced your counterparty risk by a large factor.

Risk Management

Professionals might also use margin trading to adhere to their risk management strategy. Let’s say your strategy is to only lose up to 1 percent of your trade amount in any given trade. So you enter a trade at $100 price and the logical stop loss based on the charts is at $99.70. This represents a loss of 0.3 percent. So to adhere to your risk management strategy, you would use margin trading until the stop loss represents a 1 percent loss of your traded capital.

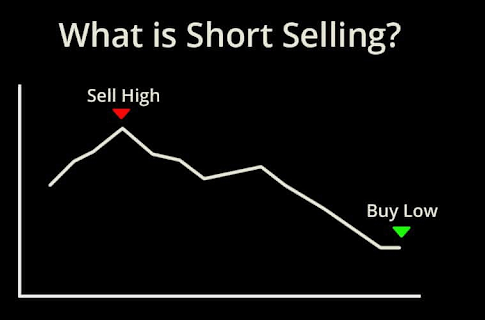

Short what?

The third and final way in which margin trading is used by professionals is in order to short an asset. Let’s say you see a severe downward trend starting on Bitcoin, but you don’t own any Bitcoin. You can still profit from the downtrend through shorting — that is, selling now to repurchase at a lower price.

By using margin trading, you can essentially borrow $1,000 in Bitcoin simply so that you can sell it at the start of the downward trend. So let’s say you sell 10 Bitcoin at $100. After watching it play out, you then buy back in at $50, giving you 20 Bitcoin. Well, you only borrowed 10 Bitcoin, but you now have 20 Bitcoin. You can pay back the borrowed amount, but still have Bitcoin left over.

Maximize your profits

So now you hopefully understand the basics on how to margin trade like a professional. But there is still a little bit more that is important for you to understand in order to maximize your potential. Let’s say you have 10 Bitcoin and each one is worth $10,000, so you have $100,000 in total capital. You already know that you might only transfer 2 Bitcoin to the exchange and leave the remaining 8 Bitcoin in your private wallet.

You then borrow 8 Bitcoin to trade with 10 Bitcoin in total. Let’s say your margin trade pair is BTC/ETH, and you trade really successfully and you end up with 12 Bitcoin. You pay back the 8 you borrowed, and transfer the remaining 4 Bitcoin into your private wallet. So you have 12 Bitcoin in your private wallet, however, during that time, Bitcoin has dropped in price to $8,000. Your total capital is 12 x $8,000, or $96,000. So even though you increased your Bitcoin holdings, your dollar value dropped.

You can actually use margin trading to avoid this loss as well! If you’re concerned about Bitcoin’s price dropping, you decide to hold your capital in the USDT stablecoin, so the $100,000 will always be worth $100,000. But your trading pair is based on Bitcoin, not USDT. You transfer $20,000 worth of USDT into the exchange and use that to borrow 10 Bitcoin currently worth $10,000.

Again you trade successfully and end up with 12 Bitcoin, but each bitcoin is now worth only $8,000. You pay back the 10 you borrowed and end up with 2 leftover. Now, remember you still have the $20,000 USDT on the exchange, plus the remaining $80,000 USDT in your wallet, totaling $100,000. So you now have $100,000 plus 2 x $8,000, or $108,000. Simply buying switching to USDT, you have increased your capital by $12,000 compared to if you’d held it all in BTC.

Now the opposite also works. If you think BTC will go up, but your trading pair is based on USDT. You hold BTC, borrow USDT, and get double the profits.

Pesky hidden costs

The last thing to be mindful of when margin trading, is to not only add in the trading fee when calculating your profits or losses, but also the interest charged per day. Of course, if you’re doing a single trade within a few hours, then this won’t affect much. But if you end up making 2 percent profit after 1 month and the interest you’re being charged ends up being 3 percent a month, then clearly you’re going to be in a loss. Now generally, the interest charges are unlikely to be that high. But for simplicity, I just gave those figures as an example.

In the next post (video) of this series, we’ll look at some of the specifics in how to set up and complete a margin trade like a professional.

Another really important lesson to learn before you start trading is understanding what a stop loss is. Read Stop Loss Strategy – The Basics to find out more.

Written by Joshua Mapperson.