“In this world, nothing can be said to be certain, except death and taxes.” Benjamin Franklin, 1789.

I believe wealthy investors operate under a different interpretation of Benjamin Franklin’s quote that regular investors overlook. Investors that aren’t in the know do as they are told, pay their taxes, and move on. Wealthy investors realize the “certainty” mentioned above means they must react to tax laws, but not necessarily pay them.

This blog will explore of one of the more practical and legal ways to avoid capital gains tax that does not involve a web of lawyers, renouncing citizenship or leaving your country. This method takes less than 5 minutes and completely erases the need to pay capital gains tax. Take a loan against your crypto.

*The loan expanded upon below is not describing the tokens you have supplied to receive interest on. This is a blog about an instant loan from deposited crypto*

Capital Gains Tax Suck

Selling your crypto, trading your crypto, or paying with crypto is a taxable event. I am not an accountant. But as a general rule of thumb in the U.S., wealthy crypto holders can expect to pay anywhere from +20% to +40% of your gains back to the government in taxes. If you held for a year or more, you would fall into the long-term capital gains bracket. This is a far better deal than the short-term capital gains bracket, but neither are attractive by any means.

There is a complex sliding scale model that determines exactly how much you will pay. You should rely on a professional crypto tax service or your trusted accountant to determine this. Today, I simply explore how to take a loan against your crypto to avoid capital gains tax. I will expand upon this by looking at a hypothetical portfolio so you can see the advantage.

Crypto Loans to Avoid Capital Gains Tax

Crypto loan services have quickly gained popularity as an alternative to paying capital gains for wealthier holders. BlockFi, Celsius Network, and Nexo are some of the more popular platforms offering crypto loans, alongside other comparable options that offer similar options. There is a good chance the platform you currently trade or store your crypto already offers this service. This removes the headache of signing up for a new platform and finding a new service you trust.

Taking a crypto loan does not require a phone call, bank visit, financial statements, credit checks or appointments. Taking out a loan from a bank is also never a guarantee. If the bank does not like you or your history, they can say no. Crypto lending platforms don’t care what you will do with the money or your past history. All they need is collateral to make the loan happen. They have the coins, you have the loan.

How to Take Out A Crypto Loan

The process of taking a loan against your crypto varies slightly from platform to platform. A few main components remain consistent including the collateral, loan amount, duration, interest, and LTV. Depending on the platform, it will offer you the ability to customize all or some of the main components of your loan. You will need to select an asset as collateral on the platform. You can guarantee just about all platforms accept Bitcoin as collateral. Most offer Ethereum, Litecoin, stablecoins and maybe a few other major tokens as options.

Before going any further in the blog or the loan process, it is important to note lending services are typically looking for wealthier customers. BlockFi, for example, has a $10,000 loan minimum. You’d need to be prepared to put up a significantly more amount of collateral to go through with the process. Celsius one-ups BlockFi with a required $15,000 loan minimum for USD, but offers much lower limits if you receive stablecoins i.e. $500. A quick Google search is enough to learn the minimum amounts to take a loan.

I recommend inputting all your desired specs to generate a custom-tailored loan offer, but the process can be as simple as just entering how much you want to receive. The platform is incurring risk and clearly needs to make money, so the terms are not the same as standard loans. If you haven’t selected a time frame or interest amount, the algorithm will calculate these values for you and clearly display all the terms.

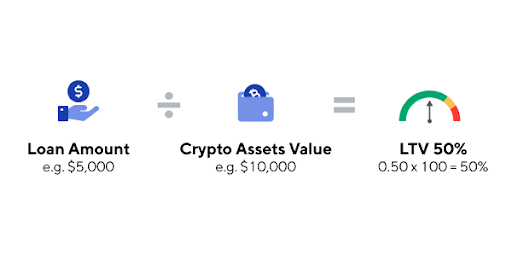

One of the most important figures to evaluate is the LTV ratio, which can be found on any crypto lending platform. The loan to value ratio represents the ratio between deposited collateral and loan amount. It is a technical term across all lending markets. In our case, it refers to the ratio of crypto you put up for collateral vs. the value you receive back.

The Loan-To-Value Ratio And Risk

As a standard in the crypto industry, you should expect platforms to enforce a best-case scenario 50% LTV ratio. This means that you will need to deposit 2x the amount you borrowing as collateral, as a minimum standard. In other words, if you want to borrow a million dollars, you will have to hand over 2 million in coins. If the ratio drops to 33%, this means your collateral would be 3x the amount you are borrowing.

Or from another perspective, a 50% LTV ratio means the loan equals half the value you put up as collateral. A 33% LTV ratio means the loan equals a third of the value you put up as collateral. If your goal is to lower your interest payments, then lower the LTV ratio and duration of the loan. Clearly, crypto loans are currently a far cry from a 3% mortgage or standard loan with a very small down payment.

Taking a loan does not come without risk. If you fail to pay back the loan in full or make all interest payments, you will have overpaid dramatically for the loan. Further, if the price of your collateral drops significantly, you will be at risk of a margin call and liquidation of assets if you do not add more coins as collateral. For example, say you have a loan with a 33% LTV and the margin call triggers at 65%. You need to reduce the LTV back down to 33%. So, if your collateral becomes devalued, you must add to your collateral until the LTV ratio returns back to what you initially agreed to.

The house is designed to win. If your collateral represents an LTV ratio in favor of the lending service, they will not reach out to you and offer money back. They will still expect interest payments. Typically, the additional collateral is locked and paid back at the end of the loan. When volatility occurs, you won’t have a lot of time to react. Sometimes lenders expect to add on within hours or risk the service selling your collateral. This is never in your favor. If you thought you were clever in that you would take a loan at the top of the bull market and pay it back later on during optimal market conditions, think again. This just sucks you into paying more for the loan.

All risks considered, a loan is a viable option with a lot of benefits to avoid capital gains tax. I expect this option to become more popular and efficient further down the road. Billionaires do it all the time with their assets to avoid being taxed. It’s completely legal. As more platforms offer this service, I expect consumers to receive better terms. This process is still in its infancy and will likely be adopted by legacy banks in the future. If you are curious about the many other ways you can use your Bitcoin, read our article titled Bitcoin is only for_______.