One of the most common questions asked about Bitcoin is “where is all of this going?” As popular as this question is, and as disinterested as some of the replies may be, it undoubtedly still lingers on everyone’s mind. With a little bit of research, you can find a handful of popular models offering their own alpha predicting the next Bitcoin cycle peak.

These models run the numbers forwards and backwards. They derive a unique prediction based on their own metrics. For a newcomer or unbiased observer, it’s likely that no model is a standout. Rather, they appear arbitrary with no answer better than the rest. What if an old wives’ tale could actually point us in the direction of a well-supported Bitcoin cycle top? Namely the Parable Of The Ox.

The Story’s Origin

The tale takes us back to a county fair in the early 1900s. Men from all over would came to attempt to correctly guess the weight of an ox. Guessing the weight was a serious challenge. It was hard to get a good look, nobody knew its exercise or eating habits and no one had insider information. Everyone’s guess was from intuition, with each individual guess appearing no better than the next.

Sir Francis Galton, a famous statistician at the time, wanted to correctly guess the weight. He discovered by averaging everyone’s guess, he would derive a number extremely close to the actual weight of the ox. After taking the average of everyone’s guess, he calculated the number 1,197lbs. The actual weight was 1,198lbs – his method was just 1lb off.

This tells us the guessing abilities of an individual are weak. But when many minds are put together, the accuracy is near perfect. The wives’ tale continues on as a metaphor for the stock market today. It elaborates on the great lengths an individual will go to guess the value of something – including complex models, insider information, and guessing what others may guess – revealing how divorced the market can be from reality.

For our purposes, the beginning of the tale and the law of averages matters most as it pertains to Bitcoin cycle tops. Let’s take a closer look at the specifics of popular Bitcoin predictions and then apply the Parable of the Ox.

Parallels of Bitcoin with the Parable of the Ox

As alluded to in the beginning, there are hundreds of Bitcoin predictions. Interested parties love making predictions even with a complete lack of evidence. Some predictions aren’t all based on intuition. They can be complex, and from traders, astrologists, major institutions, or an equivalent Bitcoin price to a comparative market cap.

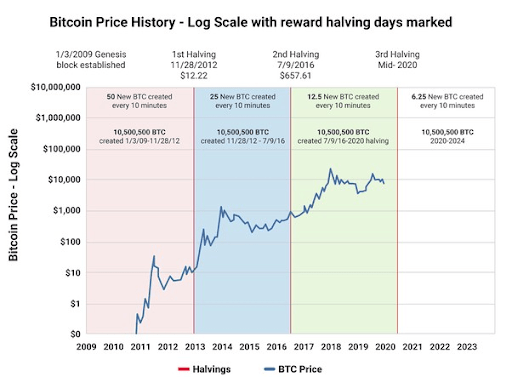

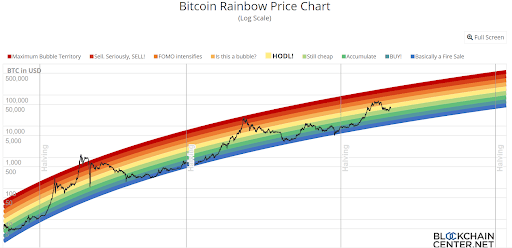

In the Bitcoin community, there are a handful of popular predictive models supported by thorough reasoning. Some of the most popular individual predictions include Plan B’s “Stock-to-Flow Cross Asset Model,” Willy Woo’s “Top Cap Model,” and Über Holger’s “Rainbow Model.”

On the flip side of individual predictions, institutions also love to throw their name into the ring. Some take conservative guesses, and others not so much. Just like individual models, institutional guesses also lie on a spectrum. Bloomberg intelligence just announced they see Bitcoin on track for “$100,000,” while Ark Investments sees Bitcoin headed to “$500,000.”

The last type of Bitcoin prediction compares the market cap of different assets to a comparative Bitcoin price. For example, many people believe Bitcoin’s market cap should be equal to or more valuable than the price of gold. This would require roughly around $500,000 per Bitcoin, so the market caps are equivalent.

This experiment has also been done comparing Bitcoin to the internet bubble, global equities, and total wealth of the world. Long story short, there are many ways to skin the cat and derive a Bitcoin prediction.

Our Predictions

So, we have discussed other predictions, but not our own. Late last year, the Wolf team considered the dilemma on many predictions and decided to handpick 9 of the most popular predictions at the time. Each was based on their own methodology, with their own unique figure to show for. In staying true to the Parable of the Ox, we calculated an average Bitcoin cycle top based on the 9 cycle tops we laid out.

The smallest figure we averaged was $90,000 and the largest was $394,500. The average of the 9 predictions equaled a cycle top of about $235,000. As a side note, our calculations didn’t take into effect the time of arrival, only price. Nonetheless, a figure we were pleased with. Around the time we ran our experiment, Bitcoin was trading at about half of its current value, $18,500. This meant from that price level, Bitcoin needed to achieve almost a 13x in price. It seemed possible but far away.

Fast forward to early this year. Bitcoin made it to $63,500, needing less than a 4x to achieve its mission. About a month after we ran our test, we noticed a Twitter user had a similar idea as us. They took it a step further to run 200 predictions instead of 9. We were pleased to see their average cycle top of all the predictions was $231,931 – extremely close to ours.

The beauty of this trick is the simplicity of it. Of course, nobody has a crystal ball to know whether these figures are accurate. But the average removes unnecessary complexity taking into account a full spectrum of absurdly high and low guesses – a method we find fascinating.

Implications

So here we are, sitting around $45,000 per Bitcoin, needing about a 5x to fulfill the prophecy, a goal that feels possible. Either way, the next time you are stumped, stuck in the middle of competing figures, data points, guesses etc. stay put, you might just find the average of everyone’s opinion to be the perfect guess.

Whether Bitcoin’s cycle peak takes us to $50,000 or $500,000, there is another important piece of the puzzle, you need to consider, it’s the fact that the greatest investors are adamant.